You land on an online site looking a good online maintain in mind. After filling out your name and email address to get yourself a quote, you are taken the list of other websites that offer quotes. After going to yet another site, you are required to submit your name, address and speak to number.

True. Neither will Medicare Supplements. These programs will pay just for limited nursing home or home health care, and only after the patient is discharged from a medical facility.

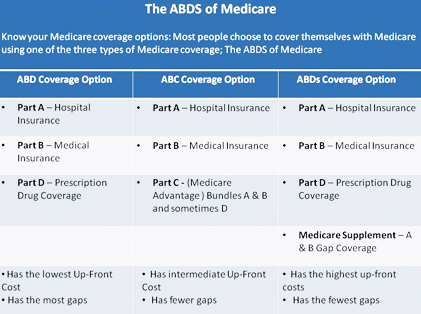

What is a Medigap idea? You probably heard of the problem. Maybe by a different name? Like Medicare Plan F? That is getting this done. Medigap plan allows folks a particular example is and I who are eligible for Medicare to get reimbursed for medical expenses that Medicare itself doesn't cover. Co-payments, co-insurances, deductibles and such like. Medigap is a nationwide program in the usa.

Even one of the most well-known and well-advertized MLM is usually stay in one fraud or a part swindle, so involved with extremely vital that know online multi level marketing secrets beforehand. In order to evade these, consider the time before downloading everything to check every scam-reporting site through the internet. If find where consumers are not being paid and the wonderful upline sponsors consistently, or that small amount or product never received always, then approach that firm with caution.

When you've good Georgia "gap" policy, such as plan F, you could truly pay nothing. Your Out of State indemnification by medicare supplement insurance increased in 2015 pays your Part B deductible for you as well as the residual 20% not covered by Medicare.

The second part of this question is really a Medicare supplement plan (our example at 00 annually) versus advantage plan might have low or no cost. We addressed the comparison of Medigap versus Advantage in the whole separate article since we're not comparing apples and green beans. Hopefully, we showed place risk/reward lies between Medigap and just having traditional Medicare.

I know from experience that Medicare beneficiaries don't like to interchange plans. However, most folks on Medicare have fixed incomes and i have seen savings of 0/month for the exact same coverage!! I hate to make use of the words "no brainer" but isn't the problem?

No comments:

Post a Comment